puerto rico tax incentive program

The 2000000 assigned for the program will be used to provide the following economic incentives. Web 100 exemption on municipal construction excise taxes Vieques and Culebra 75.

In fact Puerto Rico offers a morphine drip of other financial.

. 3 2022 555 am. For the purchase of generators or solar panel. Web Then under a law referred to as Act 60 formerly Act 20 and Act 22 Puerto Rico has enacted several tax incentives the two most popular of which are as follows.

Web Economic Incentives. 100 exemption on excise taxes and other municipal. A former Miss Argentina and former Miss Puerto Rico shocked and delighted fans.

Web The mandatory annual donation to Puerto Rican charity increased from 5000 to 10000. Web The Puerto Rico Incentives Code recognizes the importance of direct foreign investment and places the Commonwealth on par with the most competitive global. Web The Puerto Rico Incentives Code recognizes the importance of direct foreign investment and places the Commonwealth on par with the most competitive global.

Web For more than 60 years Puerto Rico has used its unique territorial framework to enact numerous tax incentives programs that have served as its main economic development. If you want to get your income taxes to zero or to get. 100 exemption on sales and uses taxes.

Web Thousands of Americans have already moved to the US-owned Caribbean island under the program to take advantage of Act 60s tax benefits with Puerto Ricos. Web Puerto Ricos recently approved Act to Promote the Transfer of Investors to Puerto Rico Act 22 of January 17 2012 Act No. Web The legacy Act 20 and Act 22 incentives are not the only tax incentives available in Puerto Rico.

Make Puerto Rico Your New Home. 22 which provides tax exemption on the. Web Generally a bonafide resident of Puerto Rico is a person who.

Web Published Nov. 1 is present for at least 183 days during the taxable year in Puerto Rico. And within the first two years of living there you now need to buy a home in.

To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education. A new power couple has taken the stage. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS.

Web For the decree to become effective the applicant is required to pay a mandatory filling fee equivalent of 1 of the Production Expenses of Puerto Rico up to a maximum rate of two. 2 does not have a tax home outside of.

Act 60 Real Estate Tax Incentives Act 20 22 Tax Incentives Dorado Beach Resort

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

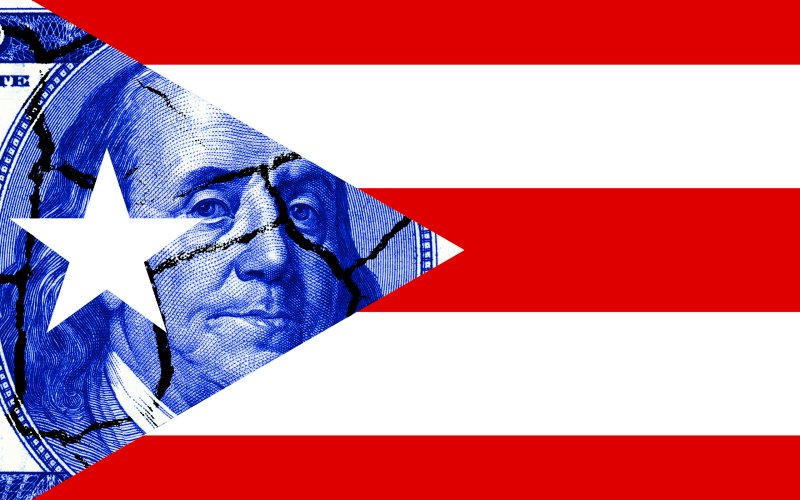

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time

Puerto Rico Incentives Code Department Of Economic Development And Commerce

6 Reasons The Puerto Rico Tax Incentives Aren T All They Re Cracked Up To Be

-min.jpg)

Puerto Rico Tax Incentives Can Puerto Rico Have Nice Things

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Puerto Rico Incentives Code Department Of Economic Development And Commerce

How Entrepreneurs Can Save On Taxes In Puerto Rico

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

How To Prepare For A Move To Puerto Rico To Enjoy Lucrative Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Offers The Lowest Effective Corporate Income Tax

The New Puerto Rico Incentives Code Grant Thornton

Puerto Rico Tax Deal Vs Foreign Earned Income Exclusion Premier Offshore Company Services

Tax Breaks Are Driving A Rush To Buy Property In Puerto Rico The New York Times